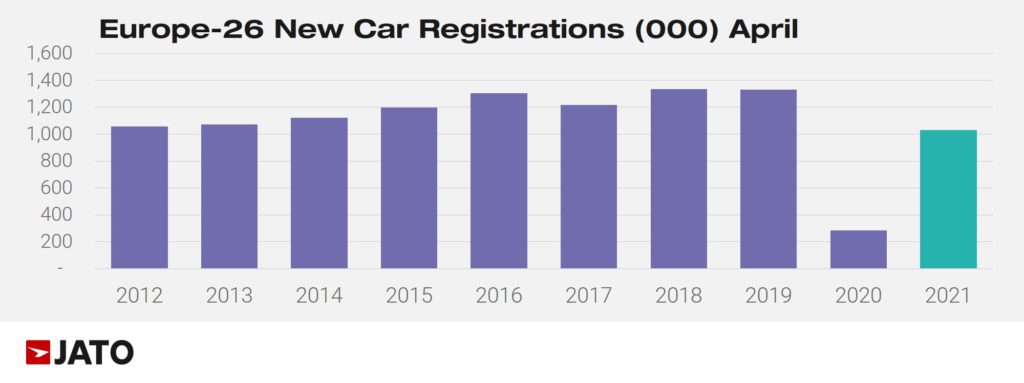

- Last month, European new car registrations were up by 261% from April 2020, but still far from pre-pandemic levels – down by 23% from April 2019

- Low emissions vehicles accounted for 15% of the total market share

- The Volkswagen ID.4 became the first SUV to secure top spot in the BEV rankings

- Once again, Peugeot led in the overall model rankings

Last month, the European new car market saw an increase of 261% when compared to April 2020 – registering 1,029,008 units. This time last year, new registrations almost ceased completely due to the introduction of lockdown restrictions in Europe and, despite significant growth since then, the market is still far from returning to pre-pandemic levels, with the total volume of new car registrations 23% lower than seen in April 2019. According to our data for 26 markets across the region, April 2021 recorded the lowest total volume in 20 years – exluding April 2020 when the pandemic was at its peak.

Felipe Munoz, global analyst at JATO Dynamics commented: “These results indicate that recovery is going to be slower than many may have expected, and in the short term, this will not offer much encouragement to OEMs already busy dealing with the challenges of adapting to emissions compliance.”

Although April’s year-to-date total was up by 23% from 2020, the total volume for January – April 2021 was 25% lower than seen in 2019, and the second lowest since 2001. Munoz continued: “While lockdown restrictions and the impact of the pandemic may seem like the root of the problem, the shift towards EVs is also having a knock-on effect. As these vehicles are more expensive, we are seeing fewer units traded in comparison with traditional ICE models.”

Despite the overall negative trend, low emissions vehicles posted record results in April 2021, with registrations accounting for 15% of the market, compared to just 11% posted a year ago. Demand for pure electric models increased by 338% to 71,500 units, and plug-in hybrids registrations recorded a volume growth of 507% to 81,000 units.

The recently launched Volkswagen ID.4 topped the BEV ranking, ahead of the ID.3 in second place. This is the first time since the introduction of pure electric vehicles that an SUV has led the BEV rankings. Munoz added: “As anticipated, the next phase of growth for EVs is going to come from SUVs. The Volkswagen ID.4 taking the lead is just the beginning of the electric-SUV trend, and we expect new models to enter the market as consumer demand increases.”

The contribution of the ID.4, in addition to strong results from other BEVs, helped Volkswagen Group gain 34% of the European BEV market in April. As a result, the German OEM performed better in the BEV market than it did in the overall market – where its market share was almost 27%.

In fact, BEVs are offsetting the losses posted by Volkswagen’s traditional ICE models. For example, the Volkswagen Golf was the third best-selling model in the overall rankings as its volume decreased by 49% between April 2019 and April 2021. In April 2018, the Golf accounted for 2.93% of all new car registrations compared with just 1.73% last month.

Peugeot was able to position both the 208 and 2008 as the first and second best-selling cars in Europe. Replicating the results we saw in February, these models occupy the first and fourth positions in the YTD ranking respectively. Both have proven to be highly competitive products within their segments, consistently outperforming the offering of more conservative competitors.