EV registrations in Europe more than doubled in 2020

According to our data for 23 markets, the volume of pure electric and plug-in hybrid cars (EVs) increased by 147% in 2020 when compared to 2019 – rising from 575,000 units to 1.42 million units. Despite the turbulent environment caused by the spread of the Covid-19 pandemic last year, EVs more than doubled.

EVs posted better results than perhaps anticipated, accounting for 12% of all new passenger cars registered in 2020. This is a significant result considering their average prices and the relatively reduced offering when compared to longstanding petrol and diesel vehicles. Throughout the year, strong efforts made by European governments have aided growth for the models.

As part of our continuous monitoring of the automotive market and its evolution, JATO Dynamics has updated their definition of ‘electrified vehicles’. This comes following the large shift towards electric engines through the adoption of pure electric cars and plug-in hybrids.

As significant differences between hybrids/mild hybrids and pure electric/plug-in hybrids continued to form, we decided to remove hybrids/mild hybrids from our definition of ‘electrified vehicles’, instead falling into the ICE category – in line with industry definitions.

Under the new definition, EVs now include pure electric vehicles (BEV) and plug-in hybrids (PHEV). This marks the exclusion of hybrids (HEV) and mild-hybrids (mHEV). This is because the primary fuel type of HEVs is not electricity but consists of either petrol, diesel or alcohol. Similarly, despite featuring an electric machine that can provide electric assistance (or torque fill/ torque boost), mHEVs are fuelled by an internal combustion engine (ICE).

1 in 4 BEVs registered were produced by Volkswagen

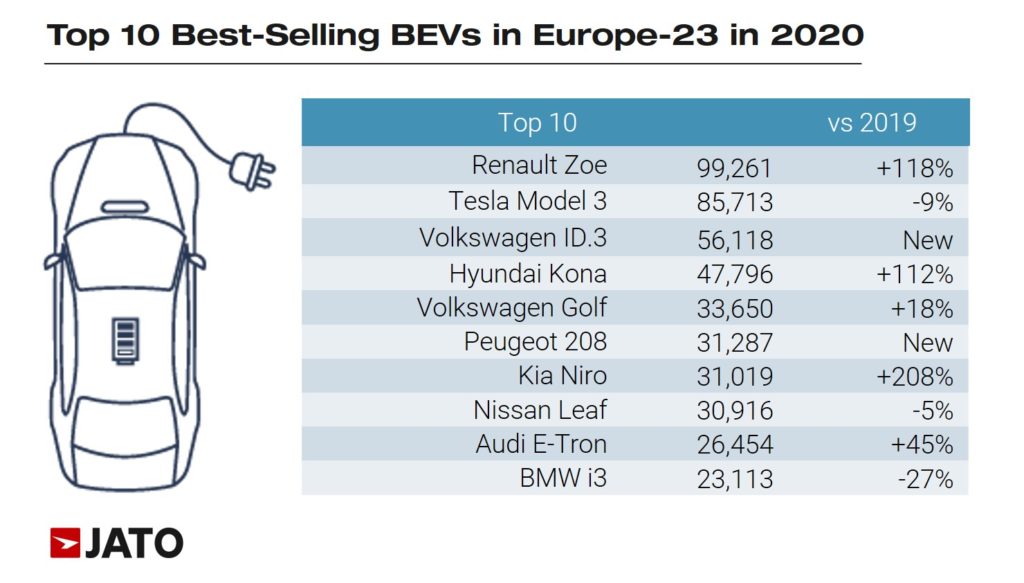

The impressive growth for EVs was partially driven by Volkswagen Group, Europe’s largest car manufacturer. While Tesla saw significant growth in 2019 – thanks to the Tesla Model 3 – Volkswagen cemented their position in the race for electrification last year.

The Volkswagen ID.3 soon became Europe’s second best-selling car in December 2020, and Volkswagen saw a range of success from varying models including the Porsche Taycan, Audi E-Tron, and Seat Mii/Volkswagen Up/Skoda Citigo.

These models helped Volkswagen to grow its market share within the BEV market to 25.2% in 2020 – almost double Tesla’s share which dropped from 31% in 2019 to 13.3% in 2020. In fact, despite holding first place in 2019, Tesla now occupies third position, currently outsold by the Renault-Nissan alliance.

The results by model also showed a significant change in the rankings last year. The Tesla Model 3 lost its crown, succeeded by the Renault Zoe which registered 99,300 units compared to the Tesla Model 3’s 85,700 units. The recently launched Volkswagen ID.3 took third position – a new model which is likely to outperform in 2021.

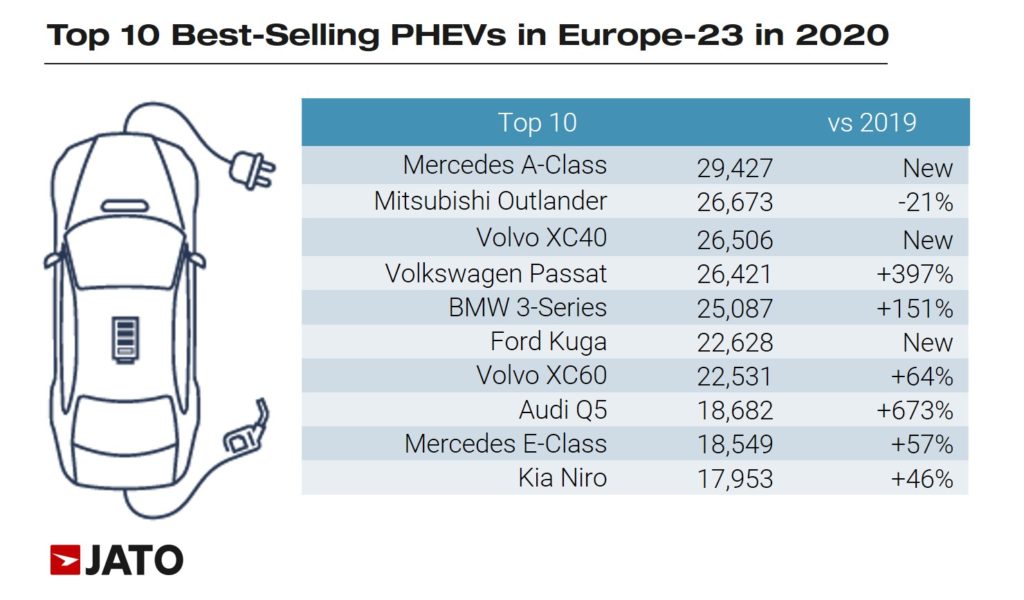

Mercedes leads among the PHEVs

Plug-in hybrid registrations in Europe have, historically, been led by the Mitsubishi Outlander. It was the first model to offer this hybrid solution and remained to be the leading example until 2020. Mercedes now occupies this position due to the success of their PHEV A-Class, E-Class and SUVs. In 2020, Mercedes held an 18% share of the PHEV market.

Markets included: Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.